Advertisement

The Complete Guide To Free Camping In The US

Jan 13, 2024

Locals Share Their Secrets: 1 Atlanta Weekend, 4 Ways

Dec 13, 2023

7 Best Places for People Traveling Alone

Feb 09, 2024

Demystifying Dividend Recapitalization: A Layman's Guide

Feb 15, 2025 By Kelly Walker

If you've ever encountered the term "Dividend Recapitalization" and found yourself perplexed, don't worry; you're in good company. This phrase can seem shrouded in corporate jargon, making it appear far more complex than it is.

However, fear not! In the following paragraphs, we will demystify this concept, stripping away the confusing layers and presenting it in straightforward language. By the end of this article, you'll clearly grasp what Dividend Recapitalization entails and why it holds significance in the financial world. So, let's embark on this journey of understanding together.

What is Dividend Recapitalization?

Imagine you're a company. You're chugging along, making money, and everything seems great. Now, you want to give something back to your Investors—those who own a piece of your business. How do you do that? You can pay them a portion of the profits as dividends.

Dividend Recapitalization is like a twist in this story. Instead of just paying dividends from your profits, you take on some debt, and with that borrowed money, you pay your Investors. It's like taking a loan to give gifts.

Debt for Dividends?

Hold on, isn't debt bad? Well, not necessarily. It depends on how you use it. In this case, you're using debt to reward your Investors. Companies often do this when they have more cash flow than they need for immediate operations or growth plans. So, they borrow money, pay dividends, and keep their investors happy.

How Does Dividend Recapitalization Work?

Understanding how Dividend Recapitalization works is like learning the steps to a dance. Let's break it down into a simple five-step routine:

- Assessing Financial Health

Like an individual reviewing their bank balance before a significant expenditure, a company meticulously assesses its financial well-being. This entails verifying that they possess a robust cash flow sufficient to adeptly handle the impending debt they intend to incur.

This crucial step ensures that the company is financially stable and capable of meeting its financial obligations while pursuing its strategic goals.

Borrowing Money

Borrowing money involves the strategic approach of seeking financial assistance, whether through a bank loan or participation in the dynamic financial markets. In this process, a company secures borrowed funds with a clear intention: to allocate these funds to disburse dividends to its valued Investors.

This financial maneuver showcases the company's commitment to providing returns to its shareholders while leveraging external resources to achieve its financial goals.

Distributing Dividends

After accumulating a sufficient cash reserve, the company distributes dividends to its Investors, symbolizing the equitable allocation of earnings from a prosperous business endeavor. This process mirrors dividing the rewards among shareholders, a tangible manifestation of their investment's success.

Managing Debt

Now, the company has new debt on its books. It's crucial to manage this debt prudently. That means making regular interest payments and eventually repaying the principal amount. Just like servicing a car to keep it running smoothly, Managing Debt keeps the company's financial engine in good shape.

Monitoring Impact

As time passes, the company keeps a close eye on how this move impacts its overall financial position and relationships with shareholders. It's like tracking your progress after adopting a new workout routine - are the results aligning with your goals?

The Financial Implications

Here are some financial implication to know about:

Debt and Risk

Remember when we talked about debt not being all bad? Well, here's the flip side. The more debt a company takes on, the riskier it becomes. If they can't meet their debt obligations, it can lead to trouble, like bankruptcy.

Stock Price Rollercoaster

The Stock Price can be a bit of a rollercoaster during Dividend Recapitalization. Initially, it often goes up because Investors love dividends. However, if they sense that the company is taking on too much debt or if profits start dwindling, the stock can take a hit.

Long-Term Strategy

Companies must think long-term. They should ensure that Dividend Recapitalization fits into their broader financial strategy. It shouldn't be a quick fix but rather a well-thought-out move.

Is Dividend Recapitalization Always a Good Idea?

Let's explore the factors that influence its success in this comprehensive guide.

The Double-Edged Sword:

Dividend Recapitalization can be likened to a double-edged sword in financial strategies. It boasts distinct advantages, including the ability to gratify Investors and sustain financial flexibility. Nevertheless, it's imperative to acknowledge the flip side of the coin, as this strategy has inherent risks.

Balancing the potential benefits with the pitfalls becomes paramount in making informed financial decisions.

When It Makes Sense:

Dividend Recapitalization represents a strategic and prudent financial decision, ideally suited for financially robust companies boasting substantial cash flows. Coupled with a meticulously structured repayment plan for the borrowed funds, it becomes a powerful tool for companies committed to enhancing shareholder value.

This strategic maneuver holds particular advantages for enterprises with a long-term vision, as it fortifies their position and bolsters stability over time, fostering a robust foundation for sustainable growth.

When to Proceed with Caution:

However, a cautious approach is necessary when considering Dividend Recapitalization. Companies grappling with existing high levels of debt financial difficulties or those charting a course for significant expansion entailing substantial capital might want to think twice.

Implementing Dividend Recapitalization under these circumstances is akin to adding more weight when you're already burdened, potentially adding strain to an already challenging situation.

Wrapping It Up

In simple terms, Dividend Recapitalization is like taking a loan to reward your Investors with dividends. It benefits both companies and Investors by providing financial flexibility and immediate returns. However, it's essential to use this strategy wisely and consider the long-term impact on your company's financial health.

So, the next time you hear about Dividend Recapitalization, you can confidently say, "Ah, I know what that is!" It might sound like a mouthful, but it's just a fancy way for companies to keep their Investors happy while managing their finances smartly. Remember, it's all about balance, just like in life!

Top Bheemeshwari Resorts To Visit: An Ultimate Guide

Oct 02, 2023

A day trip to Bheemeshwari will not be bad. The Bheemeshwari resort is situated on the banks of the Kaveri River, giving guests the true forest experience

Experience the Magic of Spain: Your Ultimate Guide to the Best Spain Day Tours

Nov 15, 2023

Take a trip through Spain's captivating scenery and extensive history by using our comprehensive guide to the greatest day trips.

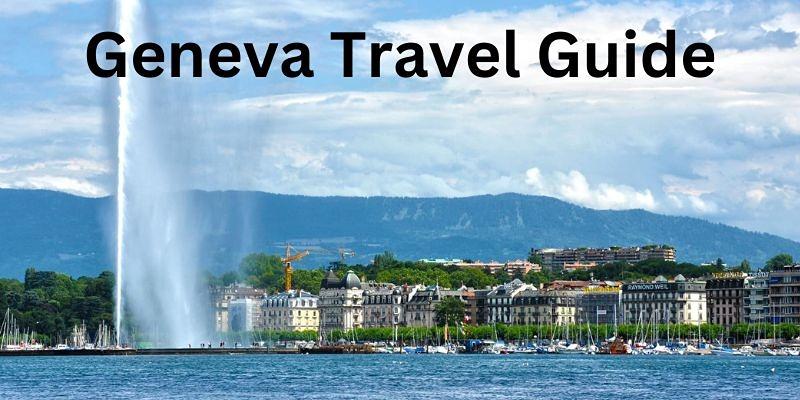

Geneva Travel Guide

Oct 30, 2023

Planning on exploring Geneva? Get the lowdown on this beautiful city with our expertly written guide. Learn about its culture, stunning views of Lake Geneva, and the majestic Alps!

Unveiling Legoland Windsor's Exciting Rides

Oct 02, 2023

Legoland Windsor promises a memorable family day. Check out our guide to the park's thrilling rides and attractions. From exhilarating roller coasters to immersive-themed events, we give thorough descriptions and insider recommendations to maximize your stay. Join us for a virtual tour of Legoland Windsor's rides to prepare for a day of laughing, excitement, and memories.

Your Guide to Rock Climbing in Coimbatore

Dec 07, 2023

Find in-depth information about rock climbing in Coimbatore. The content unleashes some amazing destinations and tip

Discover the Ultimate Festive Escapes: 25 Best Christmas Destinations Around the World

Jan 04, 2024

Explore our guide to the top 25 Christmas destinations worldwide, from snowy escapes to tropical paradises. Discover the perfect holiday getaway for a magical seasonal experience.

Everything You Should Know About Fun Outdoor Fall Festivals in the U.S

Dec 18, 2023

Fall is when the leaves change colour, the air gets crisp, and the pumpkin spice latte becomes a staple. However, it can also be a costly time to travel, with peak season prices for accommodations and airfare

Chandubi Jungle Camp, Assam: An Ultimate Guide For Travelers

Nov 15, 2023

Assam is a beautiful and peaceful state in India. It is famous for its stunning natural beauty.

What Is a HUD-1 Form?

Feb 15, 2025

Is your seller asking you to document the mortgage amount on a HUD-1 Form, but you don't know what it is? Well, lucky for you, this article contains all the crucial information you need.